Table of Contents

- WFC Stock Is the Ugliest Bank Stock on the Planet | InvestorPlace

- WELLS FARGO & WFC STOCK CHART

- WFC Stock Price and Chart — NYSE:WFC — TradingView

- WFC Stock Price and Chart — NYSE:WFC — TradingView — India

- WFC Stock Price and Chart — NYSE:WFC — TradingView

- WFC Wells Fargo Stock Price Spikes After New CEO Hire

- WFC Stock Price and Chart — NYSE:WFC — TradingView

- Wells Fargo (WFC) stock forecast: Will its outperformance continue?

- WFC Stock Price and Chart — TradingView

- WFC Stock Looks to Have Its Turnaround Already Priced In | InvestorPlace

Wells Fargo & Company (WFC) is one of the largest and most established financial institutions in the United States, with a rich history dating back to 1852. As a multinational bank and financial services company, Wells Fargo provides a wide range of services, including consumer and commercial banking, corporate and investment banking, and wealth management. In this article, we will delve into the world of Wells Fargo & Company, exploring its stock price, performance, and overall outlook.

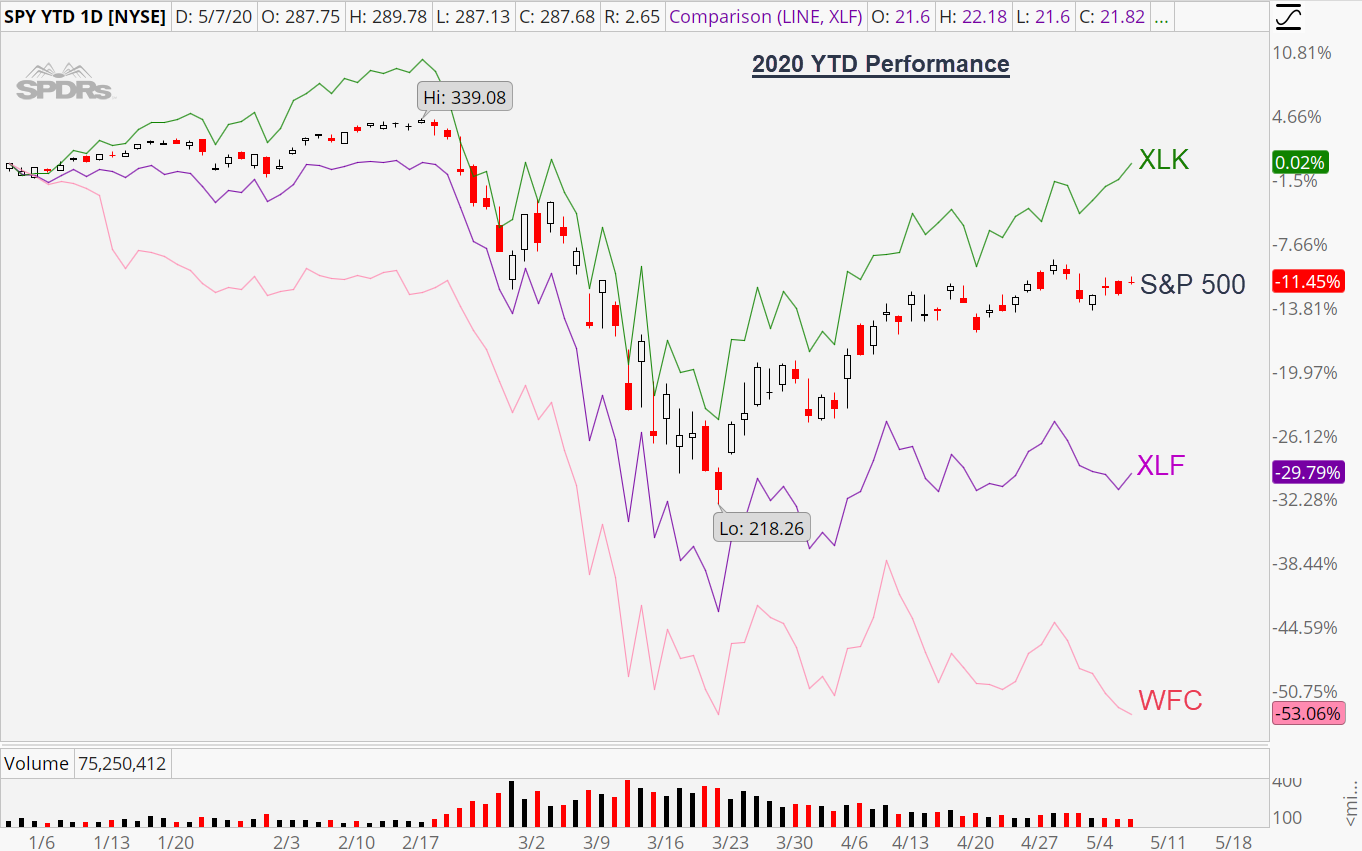

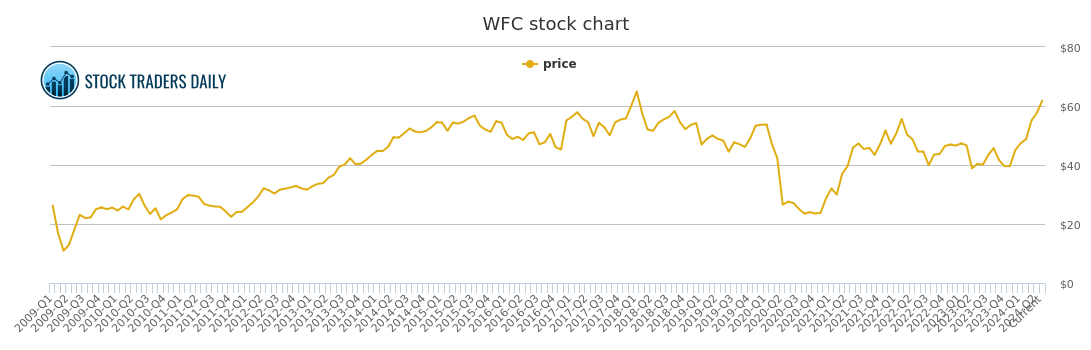

Stock Price and Performance

As of the latest market data, the stock price of Wells Fargo & Company (WFC) is around $45 per share. The company's stock has experienced a significant decline in recent years, mainly due to the impact of the COVID-19 pandemic and various regulatory challenges. However, with the economy slowly recovering and the banking sector showing signs of stability, WFC stock is expected to rebound in the coming months.

WFC's stock performance can be measured by its key metrics, including its market capitalization, dividend yield, and price-to-earnings (P/E) ratio. With a market capitalization of over $200 billion, Wells Fargo is one of the largest banks in the world. The company's dividend yield is around 2.5%, providing a relatively stable source of income for investors. The P/E ratio of WFC is approximately 12, indicating a relatively low valuation compared to its peers.

Business Overview

Wells Fargo & Company operates through three main business segments: Consumer Banking, Corporate and Investment Banking, and Wealth and Investment Management. The Consumer Banking segment provides a range of financial services, including deposit accounts, credit cards, and mortgages. The Corporate and Investment Banking segment offers a variety of financial products and services, including investment banking, commercial lending, and treasury management. The Wealth and Investment Management segment provides investment management, brokerage, and retirement services to individuals and institutions.

Wells Fargo has a strong presence in the United States, with over 5,200 branches and 13,000 ATMs across the country. The company also has a significant international presence, with operations in over 30 countries. With a diverse range of products and services, Wells Fargo is well-positioned to meet the evolving needs of its customers and drive long-term growth.

In conclusion, Wells Fargo & Company (WFC) is a well-established financial institution with a rich history and a strong presence in the United States and globally. While the company's stock price has experienced a decline in recent years, its diverse range of products and services, combined with its significant market capitalization and relatively low valuation, make it an attractive investment opportunity. As the economy continues to recover and the banking sector shows signs of stability, WFC stock is expected to rebound, providing investors with a potential long-term growth opportunity.

Investors looking to invest in WFC stock should conduct thorough research and consider their individual financial goals and risk tolerance. With its strong brand, diverse range of products and services, and commitment to customer satisfaction, Wells Fargo & Company is a company worth considering for those looking to invest in the financial sector.

Key Statistics:

- Stock Symbol: WFC

- Market Capitalization: Over $200 billion

- Dividend Yield: Around 2.5%

- Price-to-Earnings (P/E) Ratio: Approximately 12

- Industry: Financial Services

Disclaimer: The information contained in this article is for general information purposes only and should not be considered as investment advice. Investors should conduct thorough research and consult with a financial advisor before making any investment decisions.