Table of Contents

- UAL Stock Price and Chart — NASDAQ:UAL — TradingView

- United Airlines Shares Fall Despite Solid Quarter

- United Airlines Stock Fall Overlapped With Massive Social Media Outrage ...

- logotipo doble. letra dual. diseño de logotipo de letra dual. Logotipo ...

- Investing in Airlines: Risks are Growing - R Blog - RoboForex

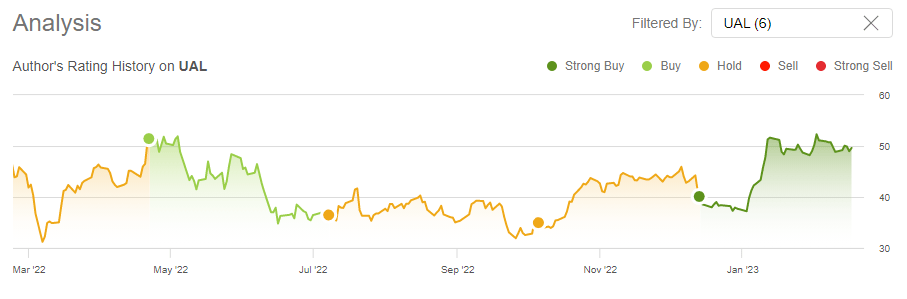

- Here is What to Know Beyond Why United Airlines Holdings Inc (UAL) is a ...

- United Continental Holdings | $UAL Stock | Shares Up 2% After Q1 ...

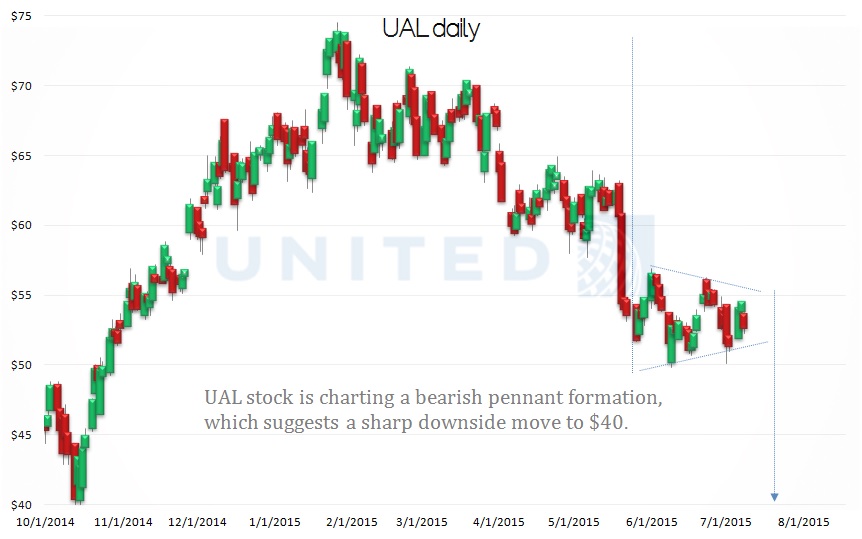

- Technical Glitches Slam United Continental (UAL) | InvestorPlace

- The United Airlines SAF Technology Investment Hype: A Drop In The Ocean ...

- UAL - United Airlines Holdings, Inc. | Stock Quote, Technical Analysis ...

As one of the largest airlines in the world, United Airlines Holdings (UAL) has been a major player in the aviation industry for decades. With a fleet of over 1,300 aircraft and a network of routes that span the globe, UAL has established itself as a leader in the market. But how has the company's stock performed in recent years, and what can investors expect from UAL in the future? In this article, we'll take a closer look at United Airlines Holdings' stock price and provide an overview of the company's current situation.

UAL Stock Price History

Over the past year, UAL's stock price has experienced significant fluctuations. In March 2020, the stock price plummeted to a low of around $18 per share due to the COVID-19 pandemic, which had a devastating impact on the airline industry as a whole. However, as vaccination efforts ramped up and travel restrictions were lifted, UAL's stock began to recover, reaching a high of over $60 per share in November 2021.

Currently, UAL's stock price is trading at around $45 per share, with a market capitalization of over $20 billion. Despite the volatility, UAL's stock has shown resilience and has been able to bounce back from the pandemic-induced downturn. The company's strong brand recognition, extensive route network, and cost-cutting measures have all contributed to its ability to weather the storm.

Financial Performance

UAL's financial performance has been improving in recent quarters, with the company reporting a net income of $1.4 billion in the third quarter of 2022. This represents a significant increase from the same period in 2021, when the company reported a net loss of $1.8 billion. UAL's revenue has also been on the rise, with the company generating $12.4 billion in revenue in the third quarter of 2022, up from $7.8 billion in the same period in 2021.

UAL's financial performance has been driven by a combination of factors, including increased demand for air travel, higher fares, and cost-cutting measures. The company has also been investing in new technologies and initiatives to improve the customer experience and increase efficiency.

Future Outlook

Looking ahead, UAL's future outlook appears to be positive. The company has a strong balance sheet, with a cash reserve of over $20 billion and a debt-to-equity ratio of 1.4. UAL has also been investing in new aircraft and technologies, including the Boeing 787 Dreamliner and the Airbus A321neo, which are expected to improve fuel efficiency and reduce emissions.

Additionally, UAL has been expanding its route network, with new flights to destinations in Europe, Asia, and Latin America. The company has also been partnering with other airlines to offer more seamless connections and improved customer experiences.

In conclusion, United Airlines Holdings' stock price has been on a rollercoaster ride in recent years, but the company's financial performance has been improving. With a strong brand, extensive route network, and cost-cutting measures in place, UAL is well-positioned for future growth. While there are still risks and uncertainties in the airline industry, UAL's stock price appears to be a good investment opportunity for those looking to diversify their portfolio. As the aviation industry continues to recover from the pandemic, UAL is likely to soar to new heights.

Investors looking to buy or sell UAL stock can do so through various online brokerages, such as Robinhood, Fidelity, or Charles Schwab. It's always important to do your own research and consult with a financial advisor before making any investment decisions.