Table of Contents

- The Return of the Bond Market | Morningstar

- The Bond Market Signals a Warning | Springwater Wealth Management

- Government Bonds, Bond Market Stock Image - Image of invest ...

- Bond Market In 2024 - Tildi Gilberte

- Bond-Market - a summary of bond market and the things you need to know ...

- Monetary Policy and the Debate about Macro Policy - ppt download

- Ranked: The Largest Bond Markets in the World – seriouslyvc

- How the Bond Market Works - YouTube

- Bond Market Forecast Next 5 Years 2024 - Eleni Tuesday

- What Bond Market Tells Us - R Blog - RoboForex

For investors and financial enthusiasts, staying up-to-date with the latest trends and analysis in the bond market is crucial. The Wall Street Journal is a leading source of news and information on bonds and interest rates, providing readers with in-depth coverage of the financial markets. In this article, we will delve into the world of bonds and rates, exploring the key concepts, current trends, and expert insights from The Wall Street Journal.

What are Bonds and How Do They Work?

Bonds are a type of investment where an investor loans money to a borrower (typically a corporation or government entity) in exchange for regular interest payments and the return of their principal investment. The bond market is a vital component of the global financial system, with trillions of dollars in bonds issued and traded daily. The Wall Street Journal provides comprehensive coverage of the bond market, including news, analysis, and data on bond prices, yields, and credit ratings.

Interest Rates and Their Impact on Bonds

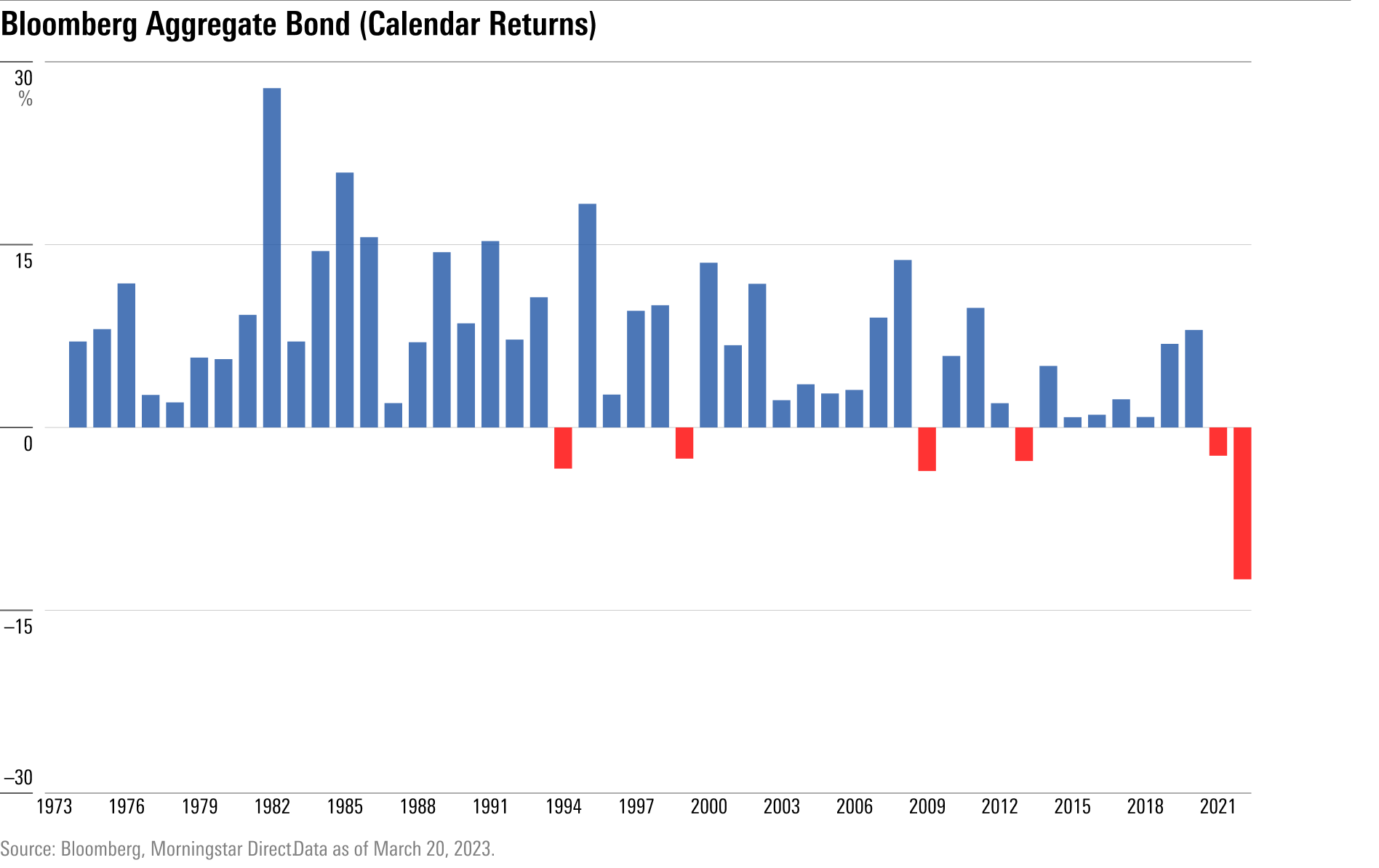

Interest rates play a significant role in the bond market, as they affect the price and yield of bonds. When interest rates rise, the value of existing bonds with lower interest rates decreases, making them less attractive to investors. Conversely, when interest rates fall, the value of existing bonds with higher interest rates increases, making them more attractive to investors. The Wall Street Journal's Bonds & Rates section provides up-to-date information on interest rates, including the latest news, analysis, and data on Treasury yields, corporate bond yields, and municipal bond yields.

Current Trends in the Bond Market

The bond market is constantly evolving, with changing economic conditions, monetary policy, and investor sentiment influencing bond prices and yields. The Wall Street Journal's expert analysts and journalists provide insightful commentary and analysis on current trends in the bond market, including the impact of central bank policies, inflation expectations, and credit market conditions. Some of the current trends in the bond market include:

- The rise of high-yield bonds, which offer higher returns to investors but come with higher credit risk.

- The growing popularity of municipal bonds, which offer tax-free income and relatively low credit risk.

- The impact of rising interest rates on bond prices and yields, and the potential for a bond market bear market.

In conclusion, understanding bonds and interest rates is essential for investors and financial enthusiasts. The Wall Street Journal's comprehensive coverage of the bond market provides readers with the insights and analysis needed to make informed investment decisions. By staying up-to-date with the latest news, trends, and expert commentary from The Wall Street Journal, investors can navigate the complex world of bonds and rates with confidence. Whether you're a seasoned investor or just starting to explore the world of bonds, The Wall Street Journal's Bonds & Rates section is an invaluable resource for anyone looking to stay ahead of the curve in the financial markets.

Stay informed and stay ahead with The Wall Street Journal's Bonds & Rates section. Subscribe today to access exclusive content, expert analysis, and real-time market data.