Table of Contents

- TLT Stock Price and Chart — TradingView

- iShares 20+ Year Treasury Bond ETF for NASDAQ:TLT by ZaloRostam ...

- TLT Stock Price and Chart — TradingView

- TLT Stock Fund Price and Chart — NASDAQ:TLT — TradingView

- The 20 year Treasury Bond versus the TLT ETF - Which is better for ...

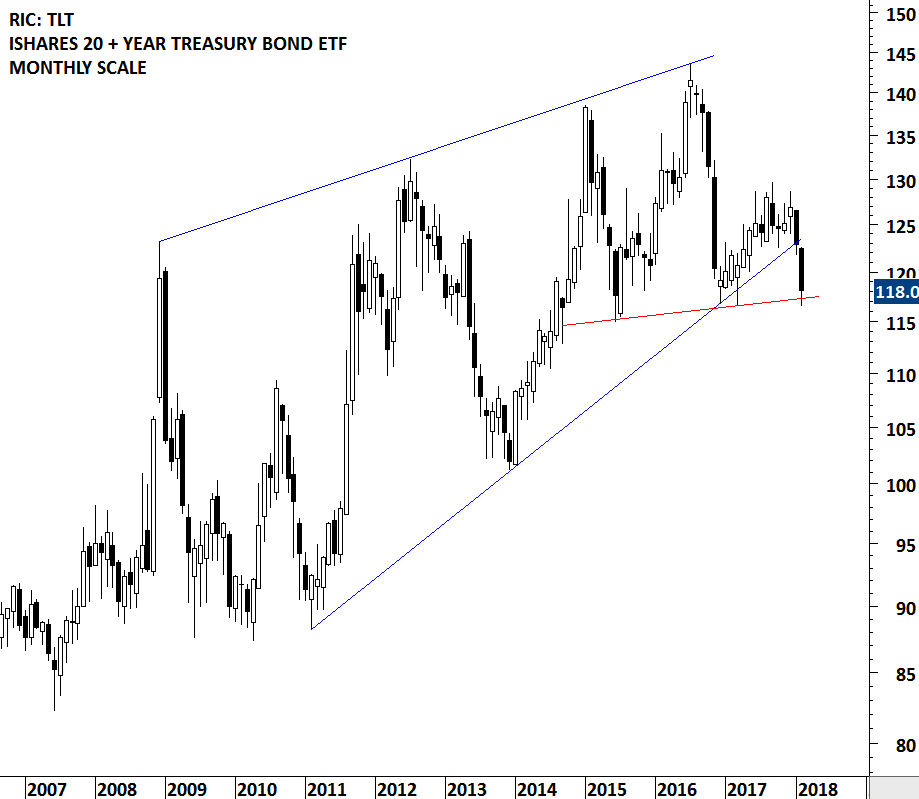

- ISHARES 20+ YEAR TREASURY BOND ETF | Tech Charts

- TLT Stock Price and Chart — TradingView

- One Chart: Long Bond ETF (TLT) - See It Market

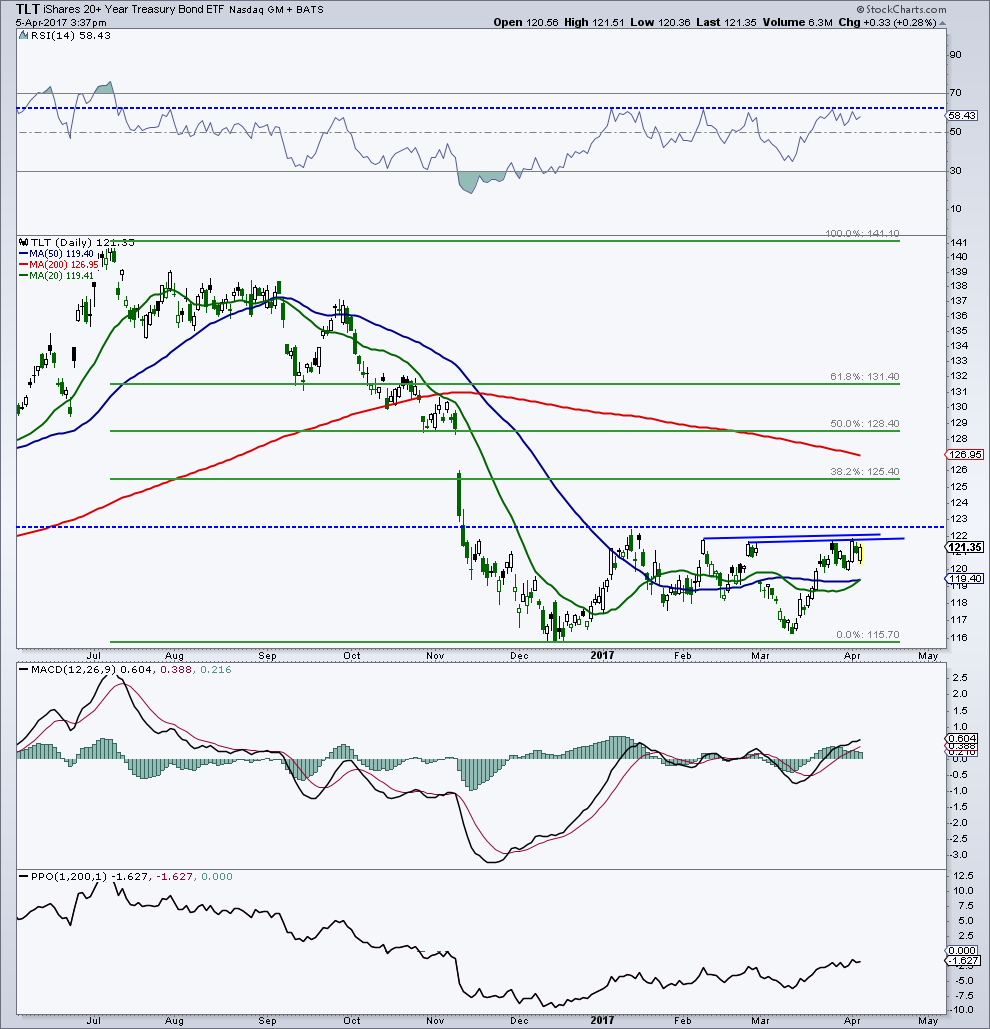

- Treasury Bonds Update (TLT): Bulls Eyeing Key Resistance - See It Market

- 미국 장기 채권 투자 ETF TLT (iShares 20+ Year Treasury Bond ETF) 소개, 구성 종목, 배당 ...

What is the iShares 20+ Year Treasury Bond ETF (TLT)?

TLT Stock Price and Performance

News and Updates

Recent news and developments have impacted the TLT ETF, including: Federal Reserve interest rate decisions, which can influence Treasury yields and, in turn, affect the TLT stock price. Inflation expectations, as higher inflation can lead to higher interest rates and decreased bond prices. Global economic trends, such as trade tensions and geopolitical events, which can impact investor sentiment and demand for long-term Treasury bonds.

Quote and Trading Information

To stay up-to-date on the TLT ETF, you can find the latest quote and trading information on financial websites such as Yahoo Finance or Bloomberg. The fund's trading volume, bid-ask spread, and other market data can help you make informed investment decisions.

Key Characteristics and Benefits

The iShares 20+ Year Treasury Bond ETF (TLT) offers several key characteristics and benefits, including: Income generation: TLT provides regular coupon payments, making it an attractive option for income-seeking investors. Capital preservation: The fund's focus on long-term Treasury bonds can help preserve capital in times of market volatility. Diversification: TLT's low correlation with other asset classes makes it an effective diversification tool for portfolios. Convenience: As an ETF, TLT offers flexibility and ease of trading, allowing you to quickly adjust your portfolio as market conditions change. In conclusion, the iShares 20+ Year Treasury Bond ETF (TLT) is a popular option for investors seeking exposure to long-term Treasury bonds. By understanding the fund's stock price, news, quote, and key characteristics, you can make informed decisions about whether TLT is right for your investment portfolio. Remember to always consult with a financial advisor or conduct your own research before making investment decisions.This article is for informational purposes only and should not be considered as investment advice. Investing in the stock market involves risks, and it's essential to assess your personal financial goals and risk tolerance before making any investment decisions.